OPEC Monthly Oil Market Report (July) – Supply Vs Demand

OPEC Monthly Oil Market Report (July) – Supply Vs Demand

Fundamental

The turbulent shock on the global economy disrupting millions of jobs and businesses in the first half of 2020 was due to the impact of COVID-19. The disruption has forced a steep decline in oil prices as demand decreased due to the severe lockdown measures applied globally to subdue the spread of the virus. To make things worse, on 8 March 2020, Saudi Arabia announced unexpected price discounts of $6 to $8 per barrel to customers in Europe, Asia, and the United States. The announcement triggered a free fall in oil prices and other consequences that day, with Brent crude falling by 30%, the largest drop since the Gulf War.

The second half of the year has begun and it seems like a light at the end of a very dark tunnel has finally starting to appear due to the international efforts of central banks supporting the economy with the unprecedented fiscal and monetary stimulus that potentially amounts to around 25% of global GDP. Nevertheless, fiscal and monetary stimulus has helped oil prices go up but not enough to regain previous years' levels. Gasoline consumption will be restained due to high unemployment and reduced commuting, affecting Aviation transportation as well.

Oil demand in all regions is forecasted to contract by 8.9 million barrels per day in 2020, adjusted up by 0.1 million barrels per day from last month’s report. The upward revision reflects slightly better-than-expected oil demand from the OECD region in second quarter of this year, which more than offset downward adjustments to non-OECD oil demand during the same quarter, mainly due to weaker-than-expected data from the Other Asia region. To offset the declining demand, OPEC+ began curbing production by 9.6 million barrels per day (till the end of July). These cuts will then begin to shrink, starting August through the end of 2020, as 7.7 million barrels per day will be taken offline. Moreover, participating non-OPEC countries to help curb oil supply. The non-OPEC liquids production in June, including OPEC NGLs, is estimated to have fallen by 1.06 million barrels per day (month over month) to average 64.02 million barrels per day. As a result, preliminary data indicates that global oil supply decreased by 2.95 million barrels per day (month over month) to average 86.29 million barrels per day, down by 12.76 million barrels per day (year over year).

The impact of the COVID-19 pandemic on the world oil market has prompted countries participating in the DoC to take historic action to mitigate the disastrous impact of the unparalleled oil demand destruction and ensuing oil supply glut.

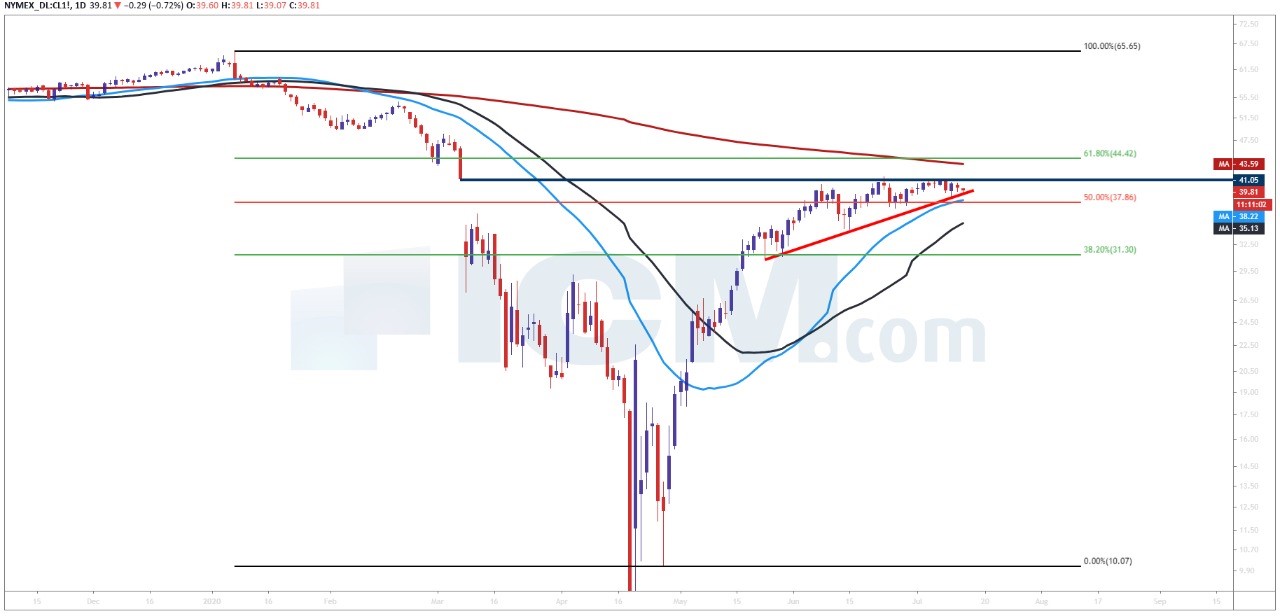

Technical

Disclaimer

The prices and news mentioned in this outlook are absolutely no guarantee of future market performance and do not represent the view of ICM.COM. Financial markets can move in either direction causing profits to be made or complete losses to be incurred by the trader. Each trader must decide for themselves what their risk appetite is and ensure that correct risk management procedures are in place before placing any trades.