Gold at $1,800 - Making the spotlight once more after 8 years

Gold at $1,800 - Making the spotlight once more after 8 years

Fundamental Analysis

Gold prices extended their upside rally, tackling the highest levels since late 2011. Several factors are supporting this upside rally.

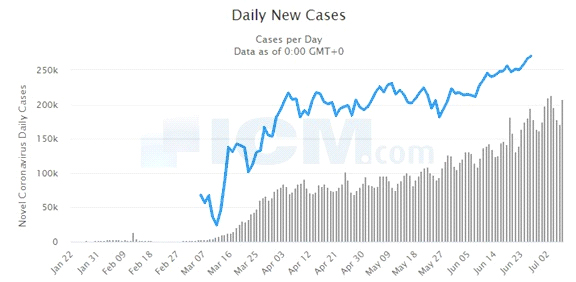

The Covid19 resurgence with daily new cases posting fresh record high, intensifying woes over another lockdown, which would disrupt the economic activity around the globe again.

As a response to the outbreak's effect on the economies, Central Banks responded by easing their monetary policies to record. Interest rates are almost around 0% in top economies, and asset purchases programs are pumping an immense amount of money in the market. Nevertheless, governments supported through fiscal stimulus. Zero or negative interest from central banks makes the precious metal more attractive, despite its lack of yield.

Moreover, tensions between the US and China over Hong Kong also imply further safe-haven flows into the yellow metal.

Technical Analysis

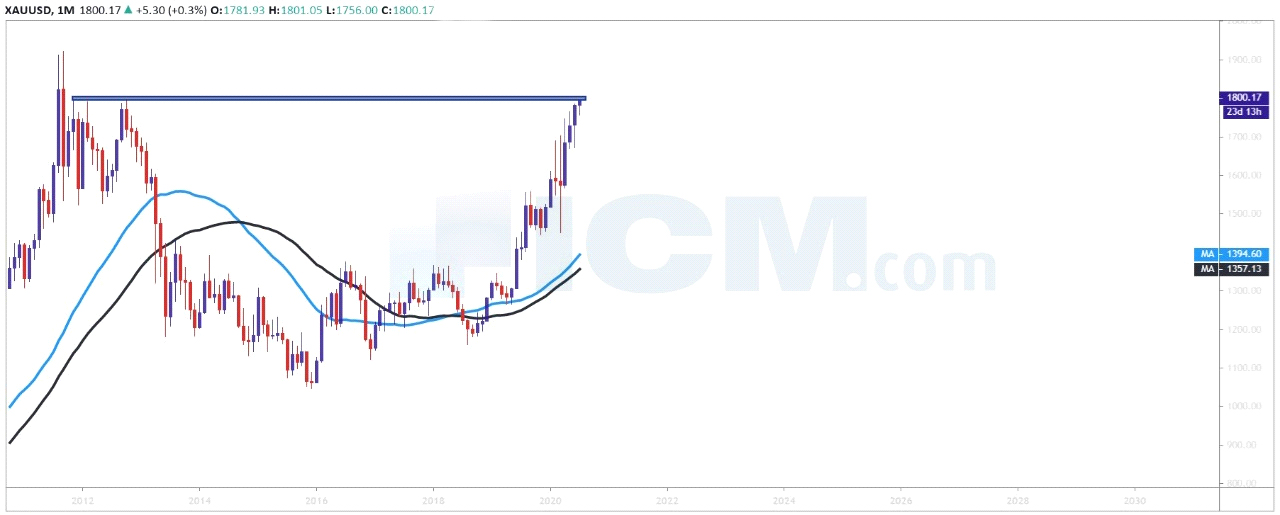

The monthly chart - Testing $1,800 levels which last seen in 2011

Gold vs COVID19 chart - Gold prices in positive correlation to number of daily news cases worldwide

Disclaimer

The prices and news mentioned in this outlook are absolutely no guarantee of future market performance and do not represent the view of ICM.COM. Financial markets can move in either direction causing profits to be made or complete losses to be incurred by the trader. Each trader must decide for themselves what their risk appetite is and ensure that correct risk management procedures are in place before placing any trades.