Earning Season – General Electric Co., General Motors Co., and QualComm Inc.

Earning Season – General Electric Co., General Motors Co., and QualComm Inc.

Fundamental

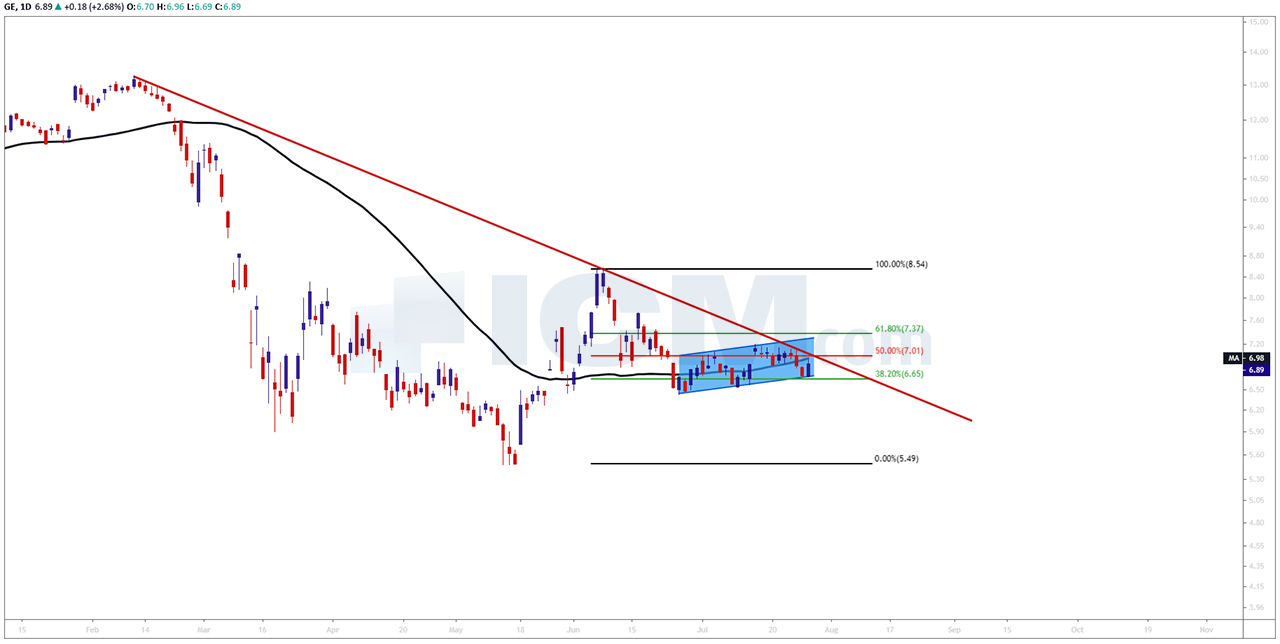

General Electric (NYSE: GE) is scheduled to announce Q2 results at 12:00 PM GMT today. The consensus EPS estimate is $-0.09 and the consensus revenue estimate is $17.27 billion (-40.1% year-on-year).

A tough year for General Electric’s aviation segment, which represents the biggest by revenue and profit and is expected to be sleepily damaged not only by the coronavirus that led to less demand for air travel due to lockdowns but also by the two fatal crashes for the Boeing 737 Max that GE is in joint venture with Boeing for this new production. This lead for airlines and aircraft lessees to cancel Max orders, complicating the prospect of future orders leading the company to sharp job cuts.

Technical

General Motors – Designs, builds and sells cars, trucks, crossovers, and automobile parts worldwide

Fundamental

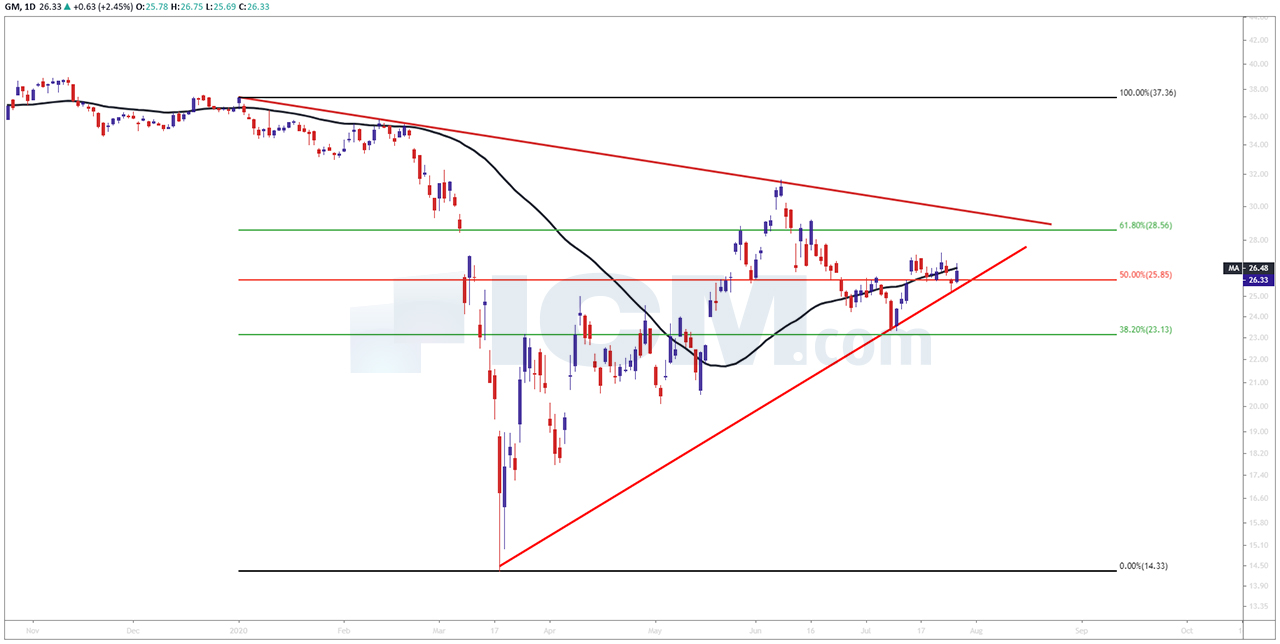

General Motors (NYSE: GM) is scheduled to announce Q2 results at 11:30 AM GMT today. The consensus EPS estimate is $-1.76 vs $1.64 in second-quarter 2019 and the consensus revenue estimate is $16.93 billion (-53.1% year-on-year).

U.S. auto production was shut down for two months to prevent the spread of the coronavirus and this left a gap with dealership inventories where automakers had to ramp up productions as soon as their doors were open. Steady gas prices combined with low-interest loans could lead to better sales, but with coronavirus cases increasing spike in some key states could curb demand back again.

Technical

Qualcomm – Designs, develops, manufactures, and markets digital communication products worldwide

Fundamental

Qualcomm (NYSE: QCOM) is scheduled to announce Q3 results at 8:45 PM GMT today. The consensus EPS estimate is $-0.71 (-11.3% year-on-year) and the consensus revenue estimate is $4.8 billion (-1.8% year-on-year).

Qualcomm is benefiting from China’s move to kickstart its economy by developing 5G infrastructure and China represents one of the most important markets for the company, but the continued geopolitical tensions between the U.S and China are likely to affect their chip revenue. However, the company unveiled a new “game-changing” 5G chipset for low-cost smartphones during the fiscal third quarter and also launched a “Small Business Accelerator Program” designed to upgrade the network infrastructures of small businesses.

Technical

Disclaimer

The prices and news mentioned in this outlook are absolutely no guarantee of future market performance and do not represent the view of ICM.COM. Financial markets can move in either direction causing profits to be made or complete losses to be incurred by the trader. Each trader must decide for themselves what their risk appetite is and ensure that correct risk management procedures are in place before placing any trades.