Earning Season – Apple Inc., Amazon Inc., Facebook Inc., and Alphabet Inc.

Earning Season – Apple Inc., Amazon Inc., Facebook Inc., and Alphabet Inc.

Apple – Designs, manufactures, and markets smartphones, personal computers, tablets, wearables, and accessories worldwide

Fundamental

Apple (NASDAQ: AAPL) is scheduled to announce Q3 results at 9:00 PM GMT today. The consensus EPS estimate is $2.07 (-5.0% year-on-year) and the consensus revenue estimate is $52.56 billion (-2.3% year-on-year).

With the second-quarter earnings that blew away Wall Street estimates, all eyes are shifting on today’s conference call to hear about how the company is recovering from the coronavirus, especially with the new spikes in cases which forced recently re-opened stores to close. On a negative note, in June, the New York Times Co. ended its partnership with Apple news, and yesterday the company faced scrutiny by U.S lawmakers and was questioned about the high fees on digital products on the App store.

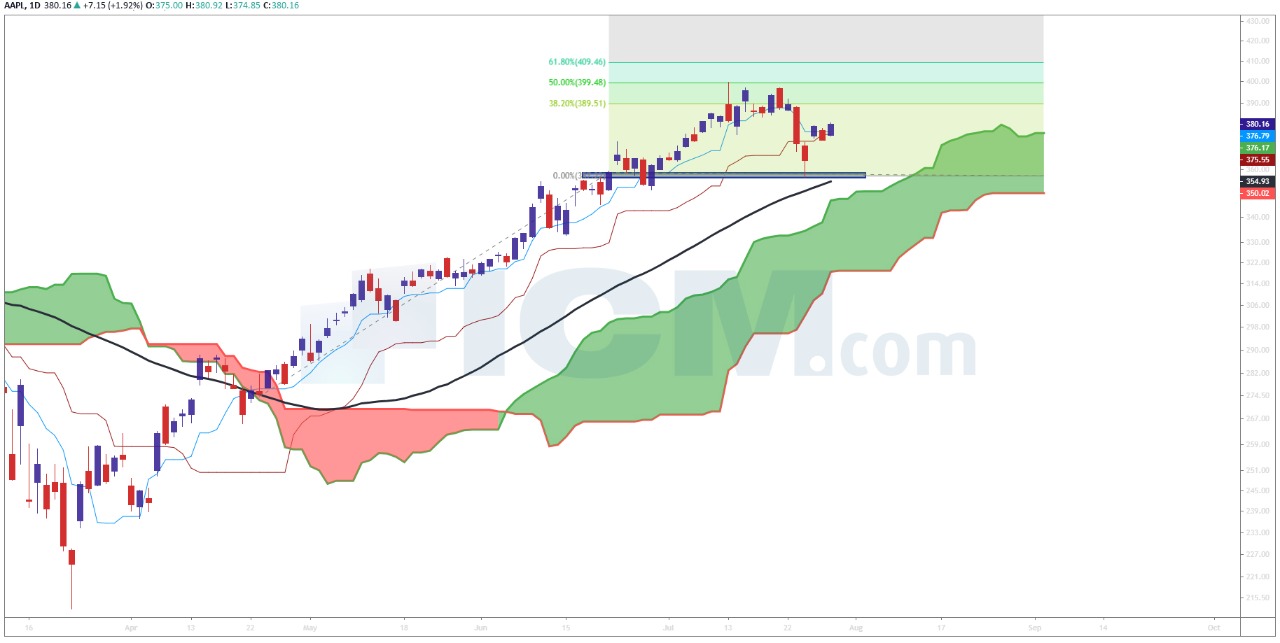

Technical

- Price is above the 50-day simple moving average and the Ichimoku cloud

- Price is finding resistance near the 38.2% area on the extended Fibonacci

Amazon – Engages in the retail sale of consumer products and subscriptions in North America and internationally

Fundamental

Amazon (NASDAQ: AMZN) is scheduled to announce Q2 results at 9:30 PM GMT today. The consensus EPS estimate is $1.62 (-69.0% year-on-year) and the consensus revenue estimate is $81.27 billion (+28.2% year-on-year).

Amazon was one of the Big Tech firms accused by U.S lawmakers yesterday for boosting profits by crushing rivals. Furthermore, on July 27th, California’s Attorney General was examining the company’s effort in protecting their workers from the coronavirus pandemic, as the investigation revealed a case where an Amazon grocery warehouse worker accused the company of providing inadequate protection.

Technical

- Price is above the 50-day simple moving average and the Ichimoku cloud

- Price is on the support line of the bullish channel

Facebook – Develops products that enable people to connect and share with friends and family through mobile devices, personal computers, virtual reality headsets, and in-home devices worldwide

Fundamental

Facebook (NASDAQ: FB) is scheduled to announce Q2 results at 10:00 PM GMT today. The consensus EPS estimate is $1.38 (-30.7% year-on-year) and the consensus revenue estimate is $17.36 billion (+2.8% year-on-year).

Facebook was also part of yesterday’s antitrust hearing, questioned about neutralizing potential competitors and about Cambridge Analytica. On a positive note, Instagram (owned by Facebook) confirmed to launch a new application called “Reels” which is set to rival “TikTok” early August of this year. “TikTok” could be banned by the Trump administration for national security reasons which could be a boost for its rivals.

Technical

- Strong resistance on the $245-$250 area

- Price is below the 50-day simple moving average, hovering near the upper band of the Ichimoku cloud

Alphabet – Provides online advertising services in the United States, Europe, the Middle East, Africa, the Asia-Pacific, Canada, and Latin America

Fundamental

Alphabet (NASDAQ: GOOG) is scheduled to announce Q2 results at 8:30 PM GMT today. The consensus EPS estimate is $8.23 (-42.1% year-on-year) and the consensus revenue estimate is $37.34 billion (-4.1% year-on-year).

Google also took part in yesterday’s antitrust hearing, questioned about stealing content from smaller Internet businesses. On a positive note, Google’s latest move against Amazon trying to gain a foothold in the online shopping world by providing sellers a zero commission basis while giving the option of using the company’s payment system or the choice of a third-party platform, starting with PayPal and Shopify.

Technical

- Pennant formed inside the bullish channel with short term support around $1,482

- Price is above the 50-day simple moving average and the Ichimoku cloud

Disclaimer

The prices and news mentioned in this outlook are absolutely no guarantee of future market performance and do not represent the view of ICM.COM. Financial markets can move in either direction causing profits to be made or complete losses to be incurred by the trader. Each trader must decide for themselves what their risk appetite is and ensure that correct risk management procedures are in place before placing any trades.