Canada's Employment Change - On the road to recovery?

Canada's Employment Change - On the road to recovery?

Fundemental

The Coronavirus outbreak has disrupted data reports to every economy worldwide. Severe measures were implemented to safeguard further fall off with financial support such as tax and mortgage deferrals, temporary wage top-up for low-income workers, low-interest loan programs for businesses, and much more. Canada's coronavirus response fund totals $1 billion, where $275 million is allocated to medical research for finding a vaccine and laughing clinical trials declared on March 11, 2020. Two weeks later on March 25, 2020, Canada backs $75 billion coronavirus relief bill. The relief fund is significantly smaller than its neighboring country, the U.S., which shed a fund over $2.4 trillion. Is the size of Canada's relief fund enough to bring back its economy before coronavirus era?

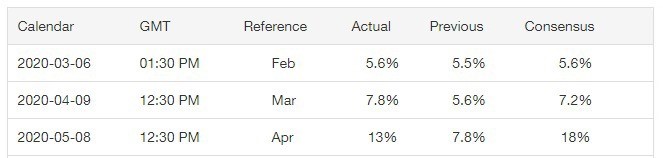

Canadian jobs losses in March and April were just over 3 million. With 289,000 returned in May and 700,000 expected in June. In May the forecast was for a further loss of 500,000 jobs after the destruction of 2 million in April. The actual result was an addition of 289,600. The resilience of the labor market is similar to the U.S, where the expectation for the prior two months was for a loss of 5 million workers but in reality, it was a gain of 7.5 million. Last week’s U.S’s NonFarm Payrolls and Unemployment were much better than expected, will Canada produce the same positive outcome?

Technical

Major Economic Events

| GMT | Country | Event | Expectation | Previous |

|---|---|---|---|---|

|

12:30 |

CA |

Employment Change (Jun) |

700 |

289.6 |

|

12:30 |

CA |

Unemployment Rate (Jun) |

12% |

13.7% |

Disclaimer

The prices and news mentioned in this outlook are absolutely no guarantee of future market performance and do not represent the view of ICM.COM. Financial markets can move in either direction causing profits to be made or complete losses to be incurred by the trader. Each trader must decide for themselves what their risk appetite is and ensure that correct risk management procedures are in place before placing any trades.